Off payroll tax calculator

Under the original IR35 legislation contractors working inside IR35 subjected their affected income to a tax. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into.

Calculating Payroll Deductions In Canada Humi Blog

Off-Payroll IR35 Calculator Use this calculator to assess the impact that the Off-Payroll IR35 legislation has on your net income.

. Free Unbiased Reviews Top Picks. The off-payroll working rules apply on a contract-by-contract basis. Contains source code for an Off-Payroll tax calculator built using React.

All Services Backed by Tax Guarantee. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. Your average tax rate is.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. The Off-Payroll IR35 legislation is a reform to IR35 that. Ad Payroll So Easy You Can Set It Up Run It Yourself.

If you earn over 200000 youll also pay a 09 Medicare surtax. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Subtract 12900 for Married otherwise.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Hourly Paycheck and Payroll Calculator. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

- off-payroll-tax-calculatorREADMEmd at gh-pages samaltyoff-payroll-tax-calculator. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period.

It will confirm the deductions you include on your. Its important to note that. Social Security tax rate.

When it comes to tax withholdings employees face a trade-off between bigger paychecks and a smaller tax bill. How tax treatment has changed from IR35 to Off-Payroll. 62 for the employee plus.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. - GitHub - samaltyoff-payroll-tax-calculator. Free Unbiased Reviews Top Picks.

2020 Federal income tax withholding calculation. Federal Salary Paycheck Calculator. That means that your net pay will be 37957 per year or 3163 per month.

A worker may have some contracts which fall within the off-payroll working rules and some which do not. Ad Compare This Years Top 5 Free Payroll Software. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Federal payroll tax rates for 2022 are. Thats where our paycheck calculator comes in. Contains source code for an Off-Payroll tax calculator built using React.

Contains source code for an Off-Payroll tax calculator built using React. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. Need help calculating paychecks.

Components of Payroll Tax. 2 days agoThe rates have gone up over time though the rate has been largely unchanged since 1992. It comprises the following components.

Ad Compare This Years Top 5 Free Payroll Software. You can enter your current payroll information and deductions and. Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings.

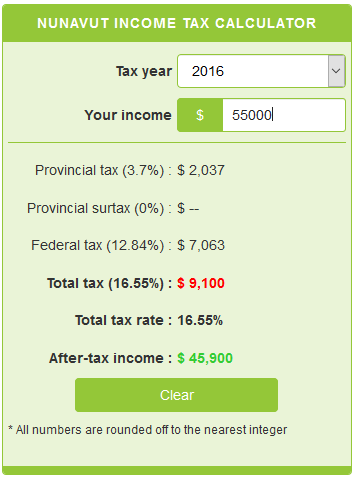

Nunavut Income Tax Calculator Calculatorscanada Ca

Off Payroll Ir35 Calculator How Much Does Off Payroll Cost You

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Your Easy Guide To Payroll Deductions Quickbooks Canada

Mathematics For Work And Everyday Life

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

How To Calculate Payroll Tax Deductions Monster Ca

How To Calculate Net Pay Step By Step Example

Mathematics For Work And Everyday Life

Payroll Calculator Free Employee Payroll Template For Excel

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting